Drowning in Delinquency, Fraud & Fragmented Tech?

Here’s the fix!

Hello there! Feeling the heat in the credit union landscape? You’re not alone. Competition is fierce, member expectations are skyrocketing,

In the dynamic world of finance, Artificial Intelligence (AI) is not just a buzzword but a game-changer for credit unions, community banks, and their call centers. AI’s transformative potential goes beyond theoretical concepts, as real success stories emerge, showcasing how institutions are leveraging AI to enhance services, drive revenue growth, and elevate member experiences. In this blog, we’ll delve into compelling AI success stories that highlight the impact AI has on credit unions, banks, and their call center operations.

In conclusion, AI’s success stories in credit unions, community banks, and call centers highlight the tangible benefits of AI adoption in the financial sector. From revolutionizing customer service with AI-powered chatbots to enhancing security with fraud detection algorithms, these institutions are realizing the potential of AI in driving member engagement, streamlining operations, and fostering innovation. These real-life successes underscore the transformative power of AI and pave the way for credit unions, banks, and their call centers to thrive in an increasingly digital financial landscape.

Hello there! Feeling the heat in the credit union landscape? You’re not alone. Competition is fierce, member expectations are skyrocketing,

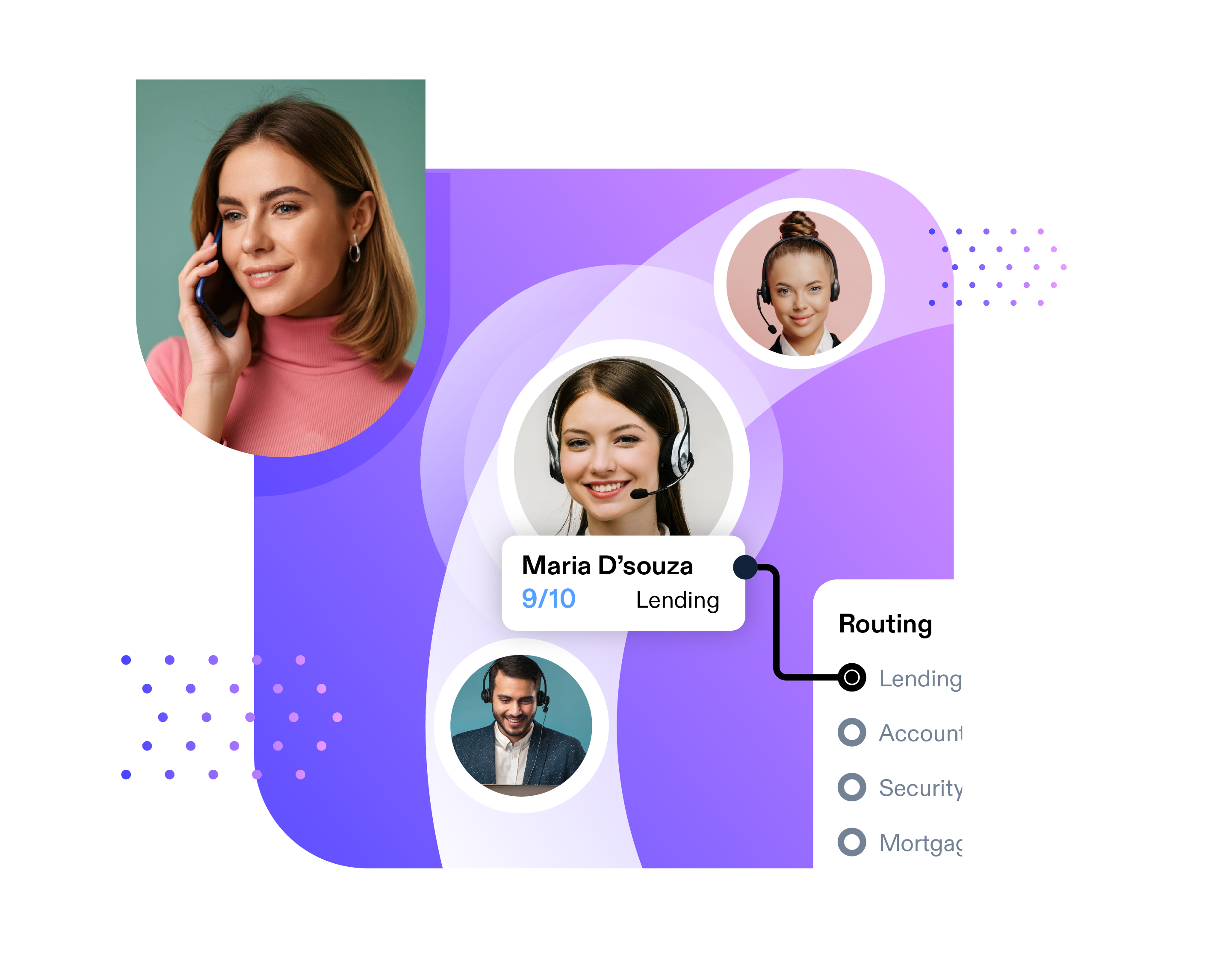

Ensure your members can connect and engage with the agent best equipped to help them across all channels – anytime,

It was a close call until my wife grabbed the phone from my hand and said, “You dummy, you’re being

© 2024 Eltropy, Inc. All Rights Reserved.