Effortless Conversations, Exponential Results.

Replace Overwhelmed Inboxes with AI-Powered Efficiencies

Every Monday, TruStone faced overflowing inboxes with hundreds of unanswered inquiries. Their overwhelmed messaging system struggled to keep up with member demands and to uphold their commitment to providing empathetic and personal member experiences.

With Eltropy, TruStone launched Ruth, an AI-powered chatbot named after their very first bookkeeper which is transforming member interactions by handling 46% of inquiries independently and delivering a stellar 9.4 out of 10 member satisfaction score.

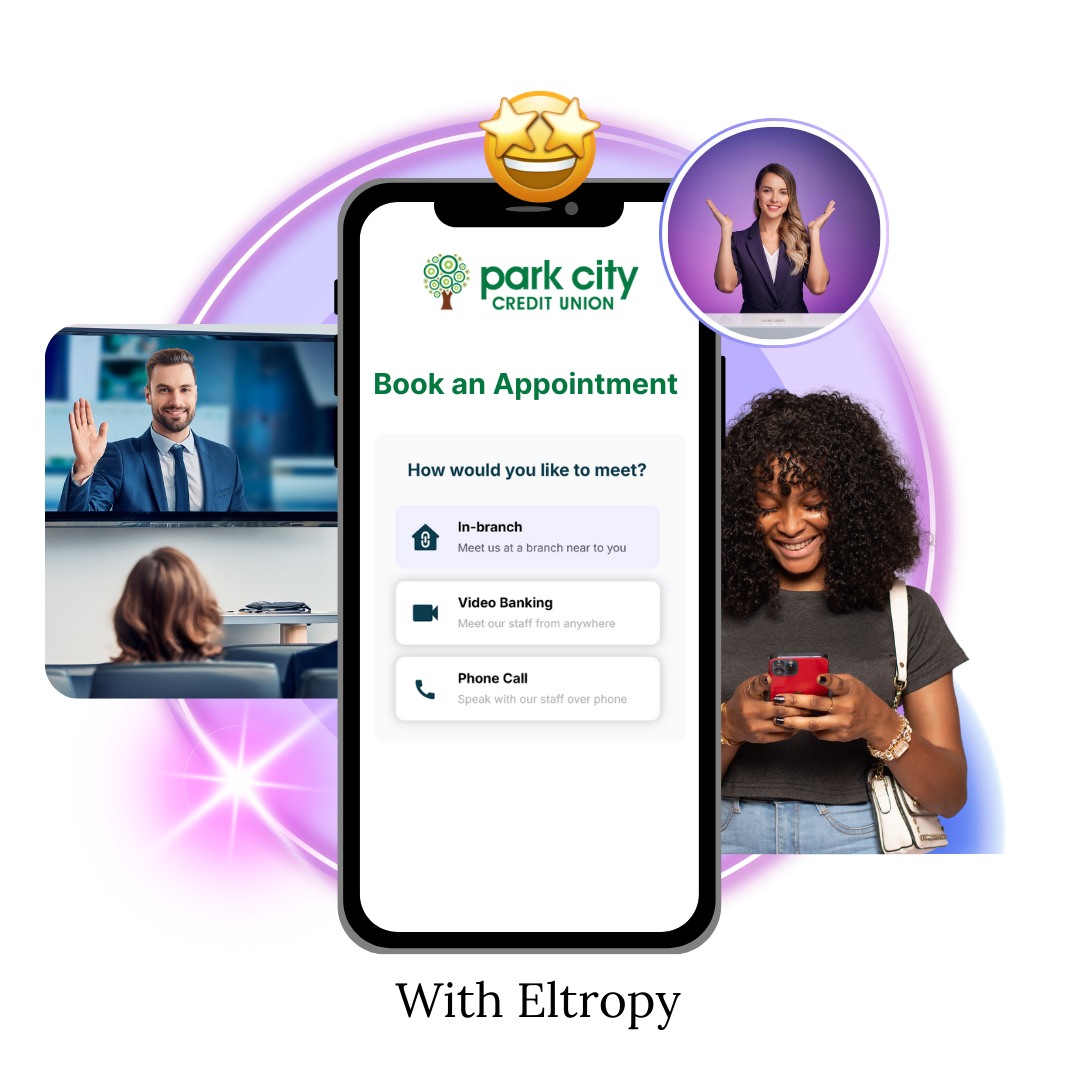

Beyond Physical Branches, Redefine Member Experience Digitally

In a world where small, rural areas struggle to access financial services, Park City Credit Union remained committed to serving their community. Yet, inadequate staffing and outdated communication channels created operational inefficiencies.

Using Eltropy, Park City reduced the average call wait times by 90% to only 30 seconds, without needing additional hires. They leveraged remote agent support to continue delivering what many consider the best member experience for many years to come.

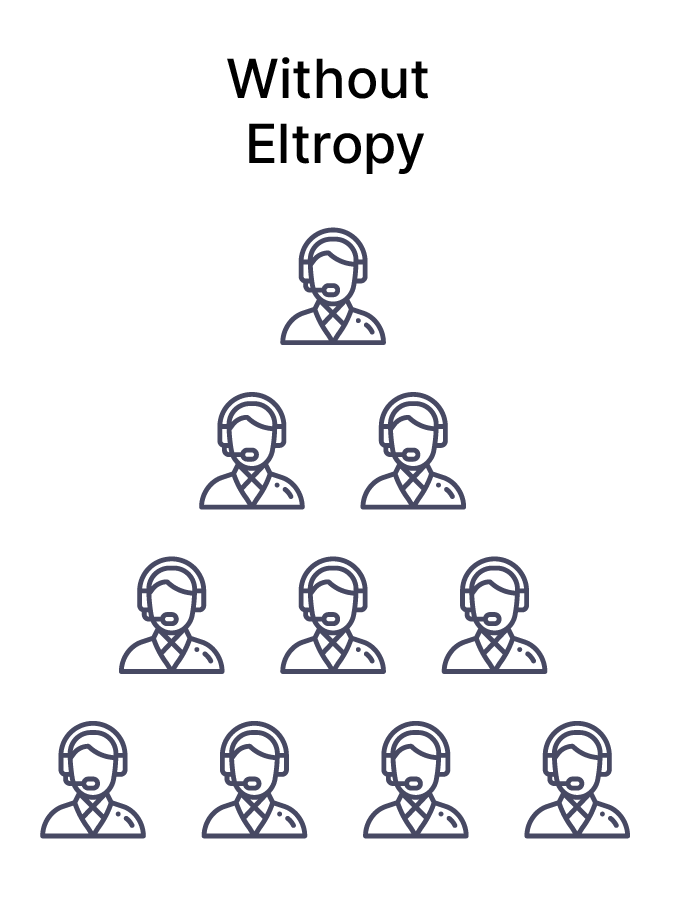

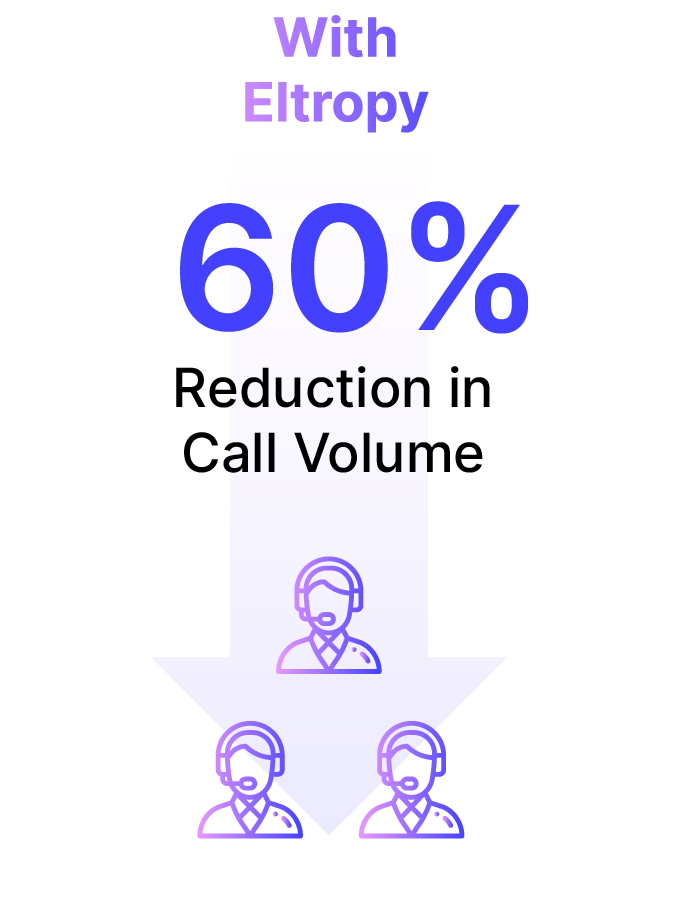

APL FCU Slashes Delinquency, Surges Savings, Achieves Record Loan Growth.

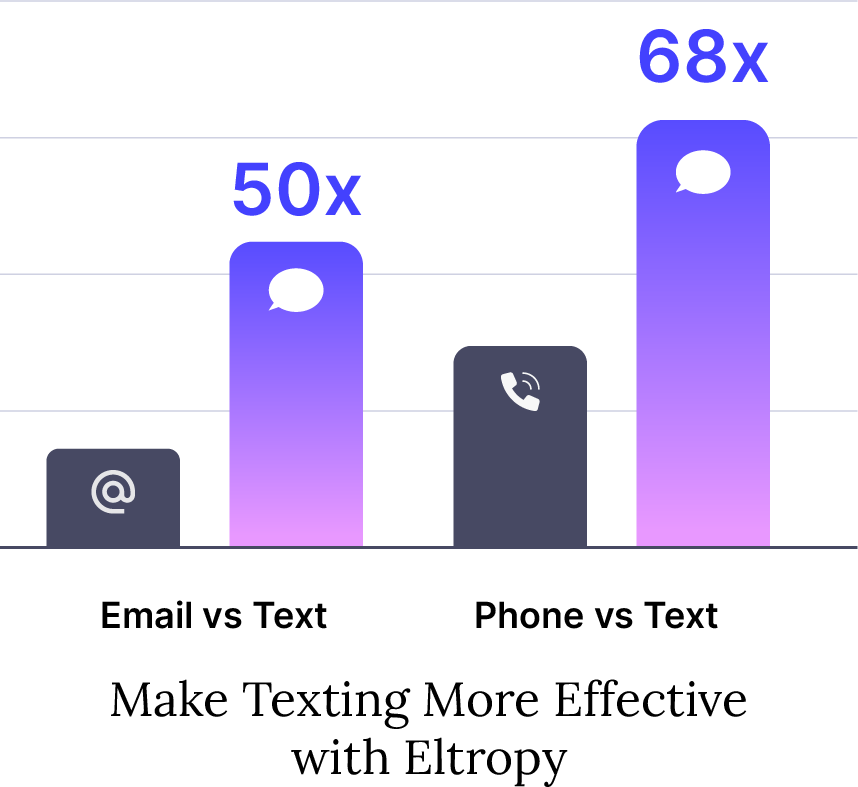

Making initial contact for a more sensitive situation like a delinquent payment is far more difficult via phone or email, and people tend to ignore these at a higher rate. APL FCU saw the advantage of using text messaging, which people are far more likely to respond to and interact with.

Within the first month of implementing Eltropy, their delinquency rates dropped by 20%, and with the ability to collect payments via secure links, the APL FCU team saw a 20% increase in savings.

Members Avoiding Collections Calls Opened Up Their Hearts On Text.

With a 98% open rate, texting is considered the most effective method for collection communication. Canvas credit union saw this in action with a 34% click rate compared to <1% engagement rate via email and a 2.56% opt-out rate versus 60% for telemarketing calls with Eltropy.

Using Eltropy’s automated reminders and collection notices during the early-stage of delinquency and 1:1 Text and Video Banking communication during late-stage delinquency obtained more collections for Canvas Credit Union.

Win-Win Efficiency For Both Members and Staff in the Collections Department.

Hughes partnered with Eltropy to connect with members via text who otherwise may feel uncomfortable connecting via phone or voicemail when behind on their payments.

With Eltropy, the collections department at Hughes overcame the challenge of struggling to open that initial line of communication with its members and saw an immediate difference: Higher response rates and Higher volumes of collections.

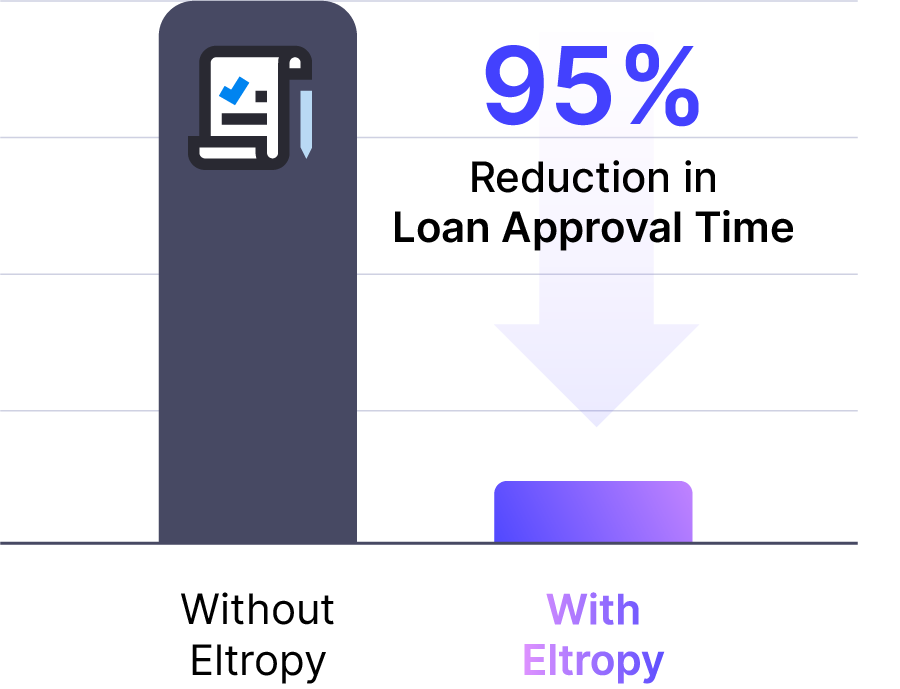

Trimmed Loan Approval Time By 95% Applications Completed <10 Minutes.

Eltropy’s DocuSign integration with 1:1 texting and secure link allowed team Centric to trim loan approval time by 95%, from 48 hours to as quick as 10 minutes.

With Eltropy, Centric replaced unanswered follow-up emails and phone tags with secure texting and document sharing. Meeting their members on their preferred schedules and communication channels enabled a seamless experience for both applicants and loan officers.